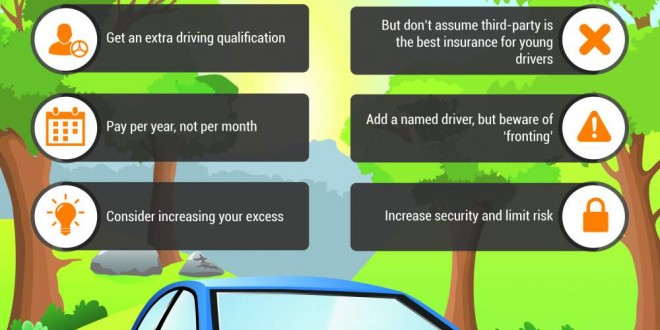

10 Tips for Cheaper Insurance For Young Drivers Infographic Portal

Life insurance can act as a safe long lasting investment whilst it protects you against the expenses which can be increasing each day. It can help you especially in light with the increasing a higher level critical diseases and hospitalisations. You can also be reassured that you receive in to the habit of thriftiness, because reminder that you have to give the insurance companies makes sure that you save regularly for the premium. You can also feel comfortable knowing that you get an assured annuity once you have retired. This is because the amount you save in your entire life, or perhaps the span that you have had insurance, is utilised like a supply of steady income. You can feel comfortable knowing that you have a secure long term investment as term life insurance is really a highly regulated sector. As far as life insurance coverage, India has the IRDA to modify the sector. People just joining can get the brand new plans A through G, which are not "new" Medicare supplement plans. They will be exactly the same as the "old" plans. Confused? If you aren't now, you'll probably be once the alterations enter into effect. So if you start asking them questions now, it might make transition easier for a few people. Holiday accident compensation claims cover a variety of accidents suffered while holidaying. Seeking the help of accident claims specialists can fasten the means of building a claim. One can make a claim if someone has suffered an accident as a result of trip on an uneven surface or slipped with a spilled liquid inside the hotel. Similarly, one can possibly go for compensation for food poisoning from poorly cooked food or a personal injury suffered on the broken tile inside swimming pool. Whatever be the cause of the injury, it's possible to get compensated for your losses suffered. Holiday accident (Travel) claim will help people get compensation for injuries suffered while holidaying. There are also a tremendous quantity of injuries related to cranes falling on the crane operator and on-site workers near the over-loaded, or improperly assembled crane systems. Both latticework and hydraulic boom cranes are prone to two-blocking. Two-blocking is understood to be, "the overuse injury in that your lower load block (or hook assembly) comes in contact with the upper load block (or boom point sheave assembly), seriously upsetting safe operation in the crane."